How to describe your business as an equation

And why you don’t fully understand your business until you can

👋 Hey, Lenny here! Welcome to this month’s ✨ free edition ✨ of Lenny’s Newsletter. Each week I tackle reader questions about building product, driving growth, and accelerating your career.

If you’re not a subscriber, here’s what you missed this month:

Subscribe to get access to these posts, and every post.

Every business can be distilled into a simple equation.

And until you can express your business as one, you don’t fully understand it.

Figuring out this equation forces you to think about the inputs that drive your business, the outputs you want to prioritize, and how these variables interact. It also gives you a map for understanding which metrics you need to track, what factors drive the growth of your business, and, most importantly, where you have the most leverage to drive an outsize amount of impact (and thus where to assign your precious people and resources).

To help you flesh out your own business equation, Dan Hockenmaier and I put together example equations for the most common tech business models:

B2B SaaS

Bottom-up B2B SaaS with seat-based pricing

Bottom-up B2B SaaS with usage-based pricing

Top-down B2B SaaS

B2C/consumer

B2C subscription (trial or freemium)

B2C free (ads)

Marketplaces

B2C marketplaces

B2B marketplaces

DTC/e-commerce

First, a few disclaimers:

This won’t be easy. These equations and concepts can be some of the most divisive within your company, particularly between your product, GTM, finance, and sales teams. But once the equations are defined, your teams are aligned, and the equations operationalized, you’ll experience a huge force multiplier—because everyone will be focusing their energy on the same (high-leverage) levers.

This won’t be perfect. While we lay out the different “recipes,” every business is unique. Thus, the equations will require some adapting to match your business. Please send us feedback (or leave a comment below) on anything you think we’re missing, or anything unique about your business that caused you to modify the equation you use. We’d love to hear it.

We focused on ARR and revenue. All of these equations output revenue or ARR. If your business has high gross margins (e.g. >80%-90%), like some SaaS businesses, you may be able to stop there. But for any business with meaningful cost of sales, such as DTC and most marketplaces, you’ll want to instead output a metric like contribution margin. For these cases, see the section at the end of the post on adding margin to your equation.

Business equations don’t cover every important metric. One key metric for every business is customer acquisition payback period. This is related to but not directly captured in the equations below. See the section at the end on how to calculate your payback period.

How to make the most of this post

Create your own business’s math formula, with inspiration from a formula below

Have a discussion with your team about how your business grows through the lens of this formula

Identify the highest-leverage lever(s) within your formula, and put more resources behind it

Identify one new lever you haven’t invested in, and experiment with it

Turn the formula into a full-fledged growth model (something we’ll explore in a future post)

A huge thank-you to Abi Noda (DX), Alex Bilmes (Endgame), Alexa Grabell (Pocus), Barry McCardel (Hex), Boris Jabes (Census), Christina Cacioppo (Vanta), Colin Dunn (Visual Electric), Dom Wong (Pogo), Emily Kramer (MKT1), Jeremy Cai (Italic), May Habib and James Lee (Writer), Merci Victoria Grace (Panobi), Nels Gilbreth, Peter Kazanjy (Atrium), Reed McGinley-Stempel (Stytch), Rujul Zaparde (Zip), Whitney Steele (Descript), William Hicks (Magic Mind), and Zach Grannis for sharing feedback and advice on this post 🙏

Also, don’t miss Dan Hockenmaier’s newsletter, which is a must-read for anyone working on growth and marketplaces.

B2B SaaS equations

A B2B SaaS business sells cloud-hosted software on a subscription basis (that’s what makes it software as a service—SaaS) to other businesses (that’s what makes it B2B). Examples include Snowflake, Slack, and Jira.

B2B SaaS businesses typically monetize in one of two ways—per seat (e.g. Slack) or by usage (e.g. Datadog)—and grow in one of two ways—through a bottom-up motion (i.e. individual employees within a company discover the product on their own, as with Figma and Notion) or a top-down motion (i.e. salespeople sell the product into company leaders, as with Salesforce and Box). And though not exactly the same thing, a bottom-up growth motion is, in practice, essentially the same as a “product-led growth” (PLG) motion.

Below, we’ll look at the three most common B2B SaaS business models, sharing both a simplified version of each business equation (as an image) and the full equation in the text under it.

1. Bottom-up B2B SaaS with seat-based pricing

Examples: Figma, Slack, Zoom, Adobe Creative Cloud, Asana, Jira.

ARR = New ARR + Expansion ARR + Reactivation ARR – Churned ARR – Contraction ARR

New ARR = New seats * price per seat

New seats = Visitors * conversion to trial/freemium * conversion to paid * seats per account

Visitors

Paid ads

SEO

Direct (e.g. word of mouth, virality)

Referral (e.g. G2, social, articles)

Conversion to trial/freemium

Visit to CTA

CTA to signup

Signup to activation

Conversion to paid

Awareness of paid plan

Starting the purchase process to completing the purchase process

Value of product

Lead nurturing

Expansion ARR = Accounts upsold * average price increase

Accounts upsold

In-product upsells

Outbound

Hitting limits

Average price increase

Seat growth

Headcount growth

Internal virality

Colleague invite rate

Invite conversion rate

Cross-sold products (e.g. Figma -> FigJam)

Hitting more expensive tiers

Raising prices

Reactivation ARR

Reactivated logos

Reactivated seats

Churned ARR

Churned logos

Contraction ARR

Seat contraction

Downgrading tiers

Stopped using additional products

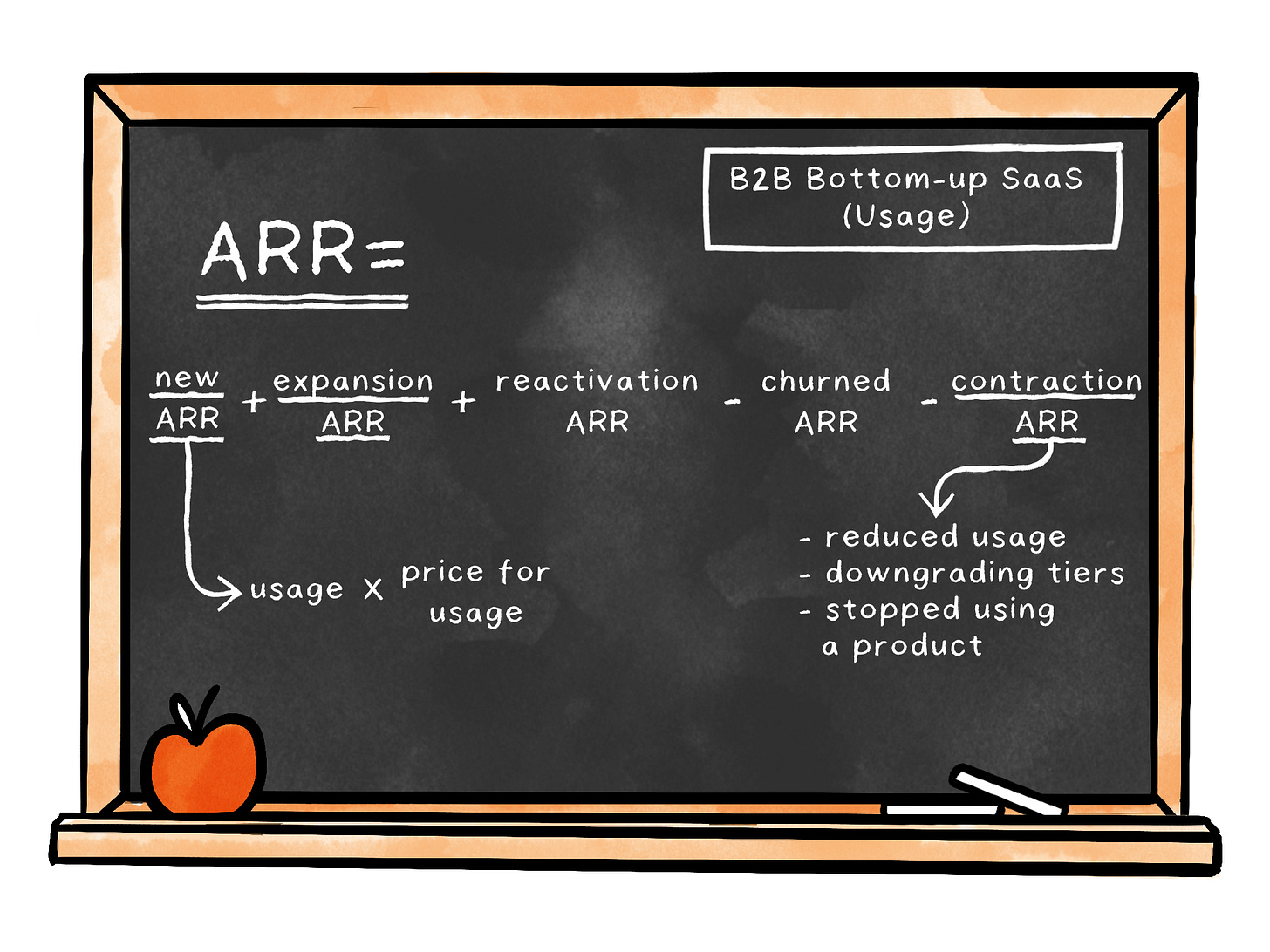

2. Bottom-up B2B SaaS with usage-based pricing

Examples: AWS, Datadog, Twilio

ARR = New ARR + Expansion ARR + Reactivation ARR – Churned ARR – Contraction ARR

New ARR = New usage * price for usage

New usage = Visitors * conversion to trial/freemium * conversion to paid

Visitors

Paid ads

SEO

Direct (e.g. WOM, virality)

Referral (e.g. G2)

Conversion to trial/freemium

Visit to CTA

CTA to signup

Signup to activation

Conversion to paid

Awareness of paid plan

Starting the purchase process to completing the purchase process

Value of product

Inbound sales/account managers nurturing leads

Price for usage

Expansion ARR = Accounts upsold * average price increase

Accounts upsold

In-product upsells

Outbound

Hitting limits

Average price increase

Usage growth

Headcount growth

Internal virality

Colleague invite rate

Invite conversion rate

Data/customer/use-cases growth

Cross-sold products (e.g. Figma -> FigJam)

Hitting more expensive tiers

Raising prices

Reactivation ARR

Reactivated logos

Reactivated users

Churned ARR

Churned logos

Contraction ARR

Reduced usage

Downgrading tiers

Stopped using additional products

3. Top-down (sales-led) B2B SaaS

Examples: Snowflake, Box, Salesforce, Workday, Looker

This category includes both seat-based and usage-based pricing and normally ends up as a predetermined negotiated annual contract.

ARR = New ARR + Expansion ARR + Reactivation ARR – Churned ARR – Contraction ARR

New ARR = Leads * qualified leads rate * meeting booked rate * win rate * ACV

Leads = Direct + indirect

Direct = Outbound + inbound

Outbound

Cold emails

Cold calls

Cold DMs

Events

Inbound

Paid ads

SEO

Referrals (e.g. G2, backlink, social mentions)

Direct (e.g. signs up for demo on website)

Indirect

Channel partnerships

Number of partnerships

Leads per partner

Conversion rate

Expansion ARR = Accounts upsold * average price increase

Accounts upsold

In-product upsells

Sales nurturing

Hitting limits

Average price increase

Seat/usage growth

Headcount growth

Internal virality

Colleague invite rate

Invite conversion rate

Data/customer/use-cases growth

Cross-sold products (e.g. Figma -> FigJam)

Hitting more expensive tiers

Raising prices

Reactivation ARR

Reactivated logos

Reactivated users

Churned ARR

Churned logos

Contraction ARR

Reduced seats/usage

Downgrading tiers

Stopped using additional products

B2C/consumer equations

Consumer businesses make a software product for individual consumers. Examples include Netflix, TikTok, and Google.

Consumer products typically monetize in one of two ways—subscriptions (e.g. Duolingo, Spotify, Tinder) and ads (e.g. Instagram, Snap, YouTube). Below, we’ll look at these two models.

4. B2C with subscription-based pricing (trial or freemium)

Examples: Duolingo, Spotify, Tinder, Calm, Strava, MyFitnessPal

ARR = MRR x 12 = (New subs + Retained subs + Reactivated subs) * Average monthly revenue per sub * 12

New subs = Traffic * visit to trial/freemium conversion * trial to paid conversion

Traffic

Paid ads

SEO

Direct/WOM

Referrals (i.e. invites)

Visit to trial/freemium conversion

Visit to onboarding

Onboarding to activation

Trial to paid conversion

Awareness of paid plan

Starting to purchase to completing purchase

Retained subs

Reactivated subs

Average monthly revenue per sub

% annual vs. monthly subs

% premium vs. basic subs

5. B2C with ads (i.e. free for the user)

Examples: Instagram, Google, TikTok, Meta, Snap, Twitter

Revenue = Active users * Impressions per user * CPM/CPC/CPA

Active users = New users in period + retained users from prior periods

New users = Traffic * conversion

Traffic

Paid ads

SEO

Direct/WOM

Organic social

Referrals (i.e. invites)

Conversion

Visit to onboarding

Onboarding to activation

Retained users from prior period

Quality of product and experience

Re-engagement (upsell/cross-sell)

Impressions per user = Sessions * impressions per session * sessions per user

Sessions

Pulling user back

Impressions per session

Ad load

Sessions per user

CPM/CPC/CPA

User quality

Geo

Income

Profession

Conversion rate from click to purchase

Marketplace equations

A marketplace business facilitates transactions between buyers and sellers. Examples include Airbnb, DoorDash, Uber, eBay, and Faire.

These businesses don’t own the supply (e.g. the homes, the cars, the restaurants) but instead make it easy for customers to find and purchase from these sellers.

Marketplaces monetize primarily through a transaction fee and occasionally through a subscription fee.

There are two types of marketplaces—B2C marketplaces, which cater to individual consumer customers (e.g. Airbnb, Uber), and B2B marketplaces, which cater to business customers (e.g. Faire, Pachama).

6. B2C marketplaces

Examples: Airbnb, Uber, DoorDash, Etsy, eBay

Revenue = Transactions * AOV * Take rate

Transactions = (New traffic + returning customers) * conversion to purchase

New traffic

Paid ads

SEO

Direct/WOM

Referrals (i.e. invites)

Returning customers

Quality of product and experience

Re-engagement (upsell/cross-sell)

Conversion to purchase

Visit to search

Search to product page

Product page to start checkout

Start checkout to complete purchase

AOV

Take rate

Supply-side commission +

Demand-side commission +

Additional revenue per transaction

Subscriptions

Financing fees

7. B2B marketplaces

Examples: Faire, Amazon Business, Pachama, Novi

Revenue = Transactions * AOV * Take rate

Transactions = Active customers * transactions/customer

Active customers = New activated customers + retained customers

New activated customers = Signups * conversion from signup to activation

Signups

Inbound

Paid ads

SEO

Direct/WOM

Referrals (i.e. invites)

Outbound

Calls

Emails

DMs

Conversion from signup to activation

Visit to search

Search to product page

Product page to start checkout

Start checkout to complete purchase

Retained customers

Conversion of new to retained customers +

Resurrection of previously active customers –

Churned customers

Transactions/customer

Quality of product and experience

Re-engagement (upsell/cross-sell)

AOV

Take rate

Supply-side commission +

Demand-side commission +

Additional revenue per transaction

Subscriptions

Financing fees

8. DTC/e-commerce equation

Finally, we have direct-to-consumer (DTC) and e-commerce businesses, which sell a physical product to individuals. This includes companies like Warby Parker, Casper, Glossier, and Dollar Shave Club.

Revenue = Transactions * AOV

Transactions = Traffic * conversion rate

Traffic = New traffic + returning traffic

New traffic

Paid ads

SEO

Direct (e.g. WOM, virality)

Returning traffic

Quality of product and experience

Re-engagement (upsell/cross-sell)

Conversion rate

Visit to search

Search to product page

Product page to start checkout

Start checkout to complete purchase

AOV (average order value)

Adding margin to your business equation

For any business with sufficiently high cost of sales, you can’t stop at revenue. What you’re really optimizing for is contribution margin, or what is left over after you take out all variable costs of a transaction.

This is a key metric because it describes how much you have left over to reinvest in the business. It’s also how more margin-intensive businesses will typically ultimately be valued, as opposed to high-margin businesses, like SaaS, which are often valued on multiples of ARR.

To apply margin to the equations above, all you have to do is calculate your average contribution margin rate (CM%) and multiply it by revenue. So for a DTC business, the formula would be:

Contribution margin = Transactions * AOV * CM%

There are two big components of cost to consider. Deducting only the first would give you a gross margin, and including the second gets you to contribution margin.

Direct variable costs: These are costs that are directly driven by a transaction and are easy to attribute. For DTC models, this would include things like cost of goods sold, incentives, and shipping. For marketplace models, it would include things like payment processing fees, incentives, and defaults.

Indirect variable costs: These are costs that are not directly driven by transactions but tend to increase as transactions increase, and include things like marketing and customer support.

Calculating payback period

For every business model here, one of the most important metrics that is not directly covered in these equations is customer acquisition payback period, i.e. the amount of time it takes for you to recoup the costs of customer acquisition. This is a better measure than LTV/CAC because it tells you how quickly you can invest in driving more growth.

At the highest level, you can calculate payback period as CAC divided by annual contribution margin per customer. For example, if you have a CAC of $100 and an average annual contribution margin per customer of $120, your payback period would be 0.83 years, or 10 months.

For certain business models, especially marketplaces, this equation gets more complicated. See “problem #2” in this essay for an explanation of how to calculate payback periods for marketplaces. Also, here are handy benchmarks for good and great payback periods.

📚 Further study

Have a fulfilling and productive week 🙏

👀 Hiring? Or looking for a new job?

I’m piloting a white-glove recruiting service for product roles, working with a few select companies at a time. If you’re hiring for senior product roles, apply below.

If you’re exploring new opportunities yourself, use the same button above to sign up. We’ll send over personalized opportunities from hand-selected companies if we think there’s a fit. Nobody gets your info until you allow them to, and you can leave anytime.

If you’re finding this newsletter valuable, share it with a friend, and consider subscribing if you haven’t already. There are group discounts, gift options, and referral bonuses available.

Sincerely,

Lenny 👋